Palos Verdes Real Estate

Home"Palos Verdes Resident since 1947"

Why Your Escrow Won’t Close on Time

Escrows almost never close on the date scheduled which, if you don’t do this every day, may seem strange. After all, both parties signed an agreement that the escrow would close on a certain date. Why doesn’t it?

There are a bunch of potential reasons, but here is by far the most common:

The buyer’s lender. This is by far the single biggest reason for late closings. It isn’t that the lender doesn’t have time to process the loan. The problem is that, apart from being swamped with re-finances in addition to purchases, most lenders, until recently, were still feeling the effects of the meltdown of 2008, when they stripped their payrolls of their higher-paid staff in an effort to cut costs. The higher-paid ones were also [shazzam!] the ones that knew what they were doing. Your comprehension of this will be greatly aided if you bear in mind that, to these loan processors sitting in a cubicle, your loan is just one of many files they must deal with. And they must deal with them without making a mistake that could cost them their job or, worse yet, cause them to be called before a committee on national TV, which trumps any deadlines such as the contracted closing date. The point is that they don’t think of these files as affecting people’s lives.

So, in the current low interest rate environment, the lender is swamped with more loan applications than he can process, especially within the time required for each. What’s a poor lender to do? Well, one thing they do is to put newly received applications at the bottom of the stack. It is a fact that a certain number of escrows are going to fall out due to reasons that have nothing to do with the lender — buyer gets cold feet, inspector looks under the house  and Jimmy Hoffa waves back, buyer doesn’t like HOA rules or financials, and on and on. For a list of the most common reasons, see my article “The Top Ten Reasons Escrows Fall Out“. Lender figures that the longer the escrow stays together, the more likely it is to close . . . so . . . they don’t really, seriously start looking at the “package” until about the last 2 weeks before the scheduled closing date. If you’re in a 60 day escrow, you can see how much navel-gazing time has gone by.

and Jimmy Hoffa waves back, buyer doesn’t like HOA rules or financials, and on and on. For a list of the most common reasons, see my article “The Top Ten Reasons Escrows Fall Out“. Lender figures that the longer the escrow stays together, the more likely it is to close . . . so . . . they don’t really, seriously start looking at the “package” until about the last 2 weeks before the scheduled closing date. If you’re in a 60 day escrow, you can see how much navel-gazing time has gone by.

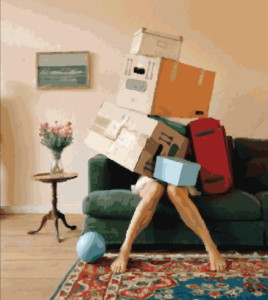

So here’s what happens: on the day the lender is supposed to deliver buyer’s loan documents, and having finally had a close look at the file, the lender asks for some obscure document that, had it been asked for in the beginning would have been easy to produce. But now, guess what . . . with escrow getting ready to close, the  buyer is [gasp!] packing and all his papers are in boxes. Well duh! Buyer, in near panic as his sale escrow is about to close and he will be on the street, rummages thru the boxes finally producing the crucial document and sends it to the lender. When the seller (or his agent) asks what the hold-up is, the reply is always “oh, we’re still waiting for documentation from the buyer”! Seriously — that’s the reply, as if the buyer is holding everything up.

buyer is [gasp!] packing and all his papers are in boxes. Well duh! Buyer, in near panic as his sale escrow is about to close and he will be on the street, rummages thru the boxes finally producing the crucial document and sends it to the lender. When the seller (or his agent) asks what the hold-up is, the reply is always “oh, we’re still waiting for documentation from the buyer”! Seriously — that’s the reply, as if the buyer is holding everything up.

Once that’s received, the file moves on to the dreaded “Final Underwriting” where one of two things happens: either a) yet more demands for documents are made, or b) buyer’s loan documents are produced with “prior to funding” conditions such as an explanation of the current status of the California State Savings Bond the buyer received upon 1965 high school graduation, or something similarly relevant.

So, 1 to 2 weeks later, escrow closes which, by the way, most lenders consider to have been “on time”, blind to the chaos it has created in the lives of the buyers and sellers.

The other reasons for delayed closing are many and varied but, as a group, they don’t even register on the scale of lender-caused delay. After doing this for 30 years, I’m real good at anticipating and solving problems; I have not, however, discovered the crystal ball that will reveal the obscure document the lender will ask for on the day of scheduled closing, and neither has anyone else, including the lender who will ask for it. So I’m just tellin’ ya.